What’s it all about

Do you want to close more deals in 2026? Start by truly understanding the companies you’re selling to. When you know how a business actually operates (I mean, its priorities, pressures, and patterns) you can shape your pitch with precision and rise above the flood of one-size-fits-all sales noise.

In short, if you want your outreach to stand out, you need more than a list of businesses to contact: you need clear, up-to-date context on what’s actually happening inside those companies.

We’ll cover how to:

- Understand what a company is focused on right now, not just what it claims on its website

- Identify meaningful changes and signals that indicate genuine sales opportunities

- Cut through scattered data using the right mix of tools, rather than endless tab-hopping

- Translate research into conversations that feel relevant, timely, and worth responding to

As JB Sales CEO John Barrows put it “If you’re not doing your research and bringing insights to the table that get the client to think differently, then you’re not getting asked to the table anymore.” So without further ado, let’s break down how to research a company for sales in a way that’s efficient, shall we?

2026: the current landscape

In 2026, buyers are better informed, inboxes are noisier, and generic outreach has a shelf life measured in milliseconds. If you want to close more deals today, you don’t need more scripts or clever subject lines. You need real context. The kind that proves you understand the company behind the logo and the people behind the job titles.

Company research isn’t about collecting trivia or sounding smart on a call. It’s about uncovering the why behind a business: why it exists, why it’s changing, and why it might care about what you’re selling right now. Done well, research turns sales conversations from pitches into problem-solving sessions. However, when done poorly, it turns into a time sink that never leaves your notes app.

This way, start by getting clear on your target. Digging into companies only pays off when you know who you’re actually looking for. That means having a solid grasp of factors like the market they operate in, their scale, where they’re based (when geography matters), how they make money, and the problems they tend to run into.

Why company research matters more than ever

Nowadays, buyers expect relevance. Not personalization theater like, say, “Congrats on your recent funding!”, but relevance grounded in reality. In other words, they want to feel understood, and not, well… targeted.

At the same time, sales cycles are compressing. What does it mean? It means fewer meetings, faster decisions, and zero tolerance for discovery calls that ask questions Google could have answered. Proper research bridges that gap and lets you focus on what really matters: risks, priorities, trade-offs, and outcomes.

In a nutshell, good research does three things:

- It helps you qualify faster

- It shapes sharper questions

- It positions your solution in context

And perhaps most importantly, it builds trust before you start talking.

Start with the company’s story

Every company tells a story about itself. Your job is to understand that story before you try to add yourself to the plot.

Begin with the company’s public-facing narrative: its website, product pages, the “About” section, blog, and recent announcements. Look for patterns: what do they emphasize repeatedly? Is it growth? Efficiency and innovation? Maybe, stability? Or, say, compliance? Those themes usually reflect what the company prioritizes internally.

Pay attention to how the company positions itself in the market. Are they a challenger or an incumbent? Are they expanding aggressively or doubling down on a niche? The language they use externally often reflects internal decision-making logic.

One way or another, this step isn’t about memorizing facts. It’s about understanding how the company wants to be perceived, which gives you a baseline for how to frame your conversation.

How Trajectory helps:

Trajectory translates scattered updates into a coherent company narrative, helping you understand how a business frames itself and where its priorities are drifting over time.

Read between the lines

Static company descriptions are useful, but change is where sales opportunities live. Look for signals that suggest motion: funding rounds, leadership changes, product launches, partnerships, geographic expansion, hiring sprees, or public shifts in strategy. These events create pressure, and pressure creates demand.

For instance, a company that just raised funding is under pressure to grow fast. A company that hired a new CTO may be rethinking its infrastructure. A company expanding into new markets is likely dealing with scale, localization, or operational complexity.

These signals help you anchor your outreach in timing. Instead of asking generic questions, you can explore how recent changes are affecting priorities and where friction might be emerging.

Understand the business model before making a move

Before diving into titles and roles, make sure you understand how the company actually makes money. Is it B2B, B2C, or hybrid? Subscription-based or transactional? Enterprise-focused or SMB-heavy? These answers shape everything from budget ownership to risk tolerance.

Once you understand the business model, org structures make more sense. You’ll see why certain teams exist, why decisions move slowly or quickly, and where influence is likely concentrated. This context prevents a common mistake: pitching value that sounds impressive but doesn’t align with how the company measures success.

How Trajectory helps:

By combining firmographic data with behavioral signals, Trajectory gives context on how companies operate, grow, and make decisions, long before you map individual roles.

Use LinkedIn as a behavioral signal, not a database

LinkedIn is often treated like a directory, and that’s what I call a missed opportunity. And the reason is simple: beyond job titles, LinkedIn reveals behavior. What leaders post about, what they comment on, or what content they engage with. These signals tell you what’s top of mind and what language resonates internally.

Company pages show hiring trends, growth signals, and strategic focus. Individual profiles reveal priorities, frustrations, and professional identity. For instance, a VP who posts about scaling teams thinks differently from one who posts about cost control.

Thus, you need to observe patterns. The goal isn’t to reference posts awkwardly on a call, but to shape your framing so it aligns with how your buyer already thinks.

Turn research into better questions

The purpose of research is to ask better questions. Strong research leads to questions that show insight without sounding assumptive. That is to say, questions that open conversations instead of closing them.

For example, instead of asking what a team does, you might explore how recent growth has affected coordination. Instead of asking about priorities, you might explore how success is measured this quarter. These questions signal respect. They show you’ve done your homework and that you’re there to understand, not to perform.

Balance depth with speed

One of the biggest traps in company research is overdoing it. I mean, you can always learn more and dig deeper. However, the bad news is that research stops adding value at some point. Effective sales research is time-boxed and goal-driven. Remember: you’re not writing a thesis, but preparing for a conversation.

A focused 15-20 minutes often delivers more value than an hour of unfocused browsing. The goal is clarity, not completeness. If your research doesn’t change how you frame your outreach or shape your questions, it’s probably too much.

Research is an ongoing process

Company research doesn’t end once the call starts. In fact, it gets more interesting. As you learn more about internal dynamics, priorities, and constraints, your understanding should evolve. Each interaction adds nuance, and each answer refines your mental model.

Many industry professionals agree that great sellers update their perspective continuously. They listen for contradictions, tensions, and unspoken concerns. Research becomes a feedback loop, not a checklist. This mindset shift is what separates transactional selling from strategic selling. Why is it important? According to Rain Group research, 71% of buyers want sellers to bring new ideas that help drive better business results.

Trajectory helps you make more sales

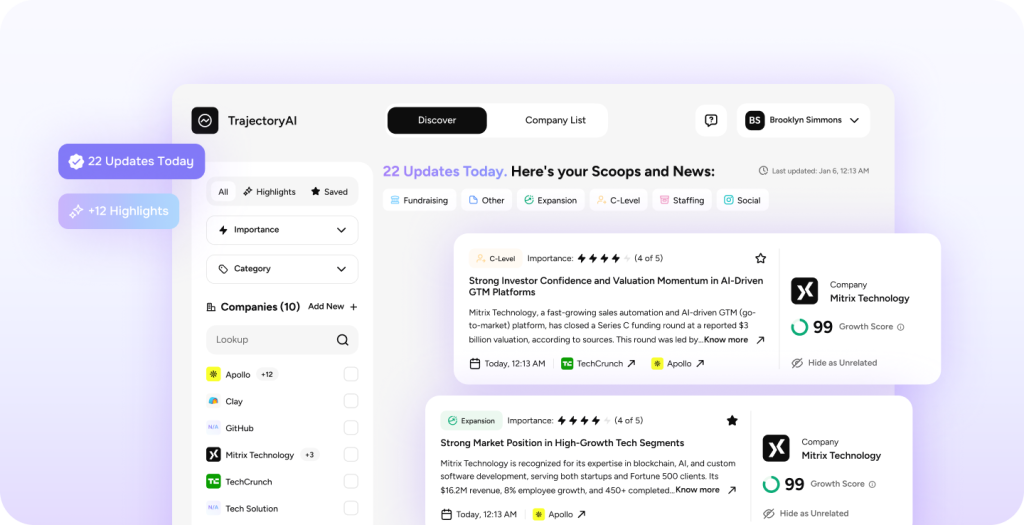

When you’re getting ready to launch a new outreach campaign, there’s one thing that matters more than anything else: knowing what’s actually happening inside the companies you’re targeting. That’s where TrajectoryAI comes in.

Trajectory.ai continuously tracks your target accounts and turns scattered signals into clear, readable company snapshots. Instead of digging through tabs, tools, and news alerts, you get a live picture of how a business is changing and why it matters for sales.

With Trajectory.ai, you see insights such as:

- What the company is focused on right now

- Recent changes across leadership, teams, and strategy

- Signals tied to growth, restructuring, or shifting priorities

- Competitive moves, partnerships, and market activity

- AI-generated summaries that explain what changed and why it matters

For example:

If you’re selling to a VP of Sales at a fast-growing SaaS company, Trajectory.ai highlights hiring momentum, leadership changes, and competitive pressure so you can speak directly to scale-up challenges instead of guessing.

If you’re targeting a manufacturing firm, Trajectory.ai helps you validate fit by surfacing expansion signals, operational changes, or market moves that indicate real buying intent, not just a static firmographic match.

The bottomline

Trajectory.ai doesn’t just collect data, it connects the dots. Each account comes with a narrative view that shows how events stack up over time, so your outreach reflects context, not coincidence.

You can then:

- Align your messaging with what’s actually happening inside the account

- Prioritize outreach based on momentum, not assumptions

- Sync insights into your existing sales workflow

- Run account-based campaigns that feel timely, not templated

Instead of chasing raw data, Trajectory.ai helps you understand the story behind each company, so every conversation starts one step ahead. Think fewer spreadsheets, fewer guesses, and a lot more “this makes sense” moments.

Summing up

In all fairness, researching a company for sales isn’t really about sounding prepared. Rather, it’s about being useful and sympathetic. When you understand a company’s story, pressures, and priorities, you stop guessing. Your outreach becomes relevant, and questions become sharper. In other words, your offer (and its value) becomes clearer.

In a world where buyers are tired of being sold to, research is how you earn the right to have a real conversation. You shouldn’t know everything – just what matters. And if there’s one rule worth remembering, it’s this: research should make your buyer feel understood, not impressed. It’s important because the deals tend to follow naturally exactly from there.